UK vehicle production fell by almost 12% last year and is set to fall further this year – but industry chiefs insist it's a short-term issue due to factories retooling to build new EVs.

The figures from the Society of Motor Manufacturers and Traders (SMMT), which includes cars and vans, showed 905,233 units were produced in the UK in 2024. That figure consists of 779,584 cars and 125,649 commercial vehicles.

While car production fell by almost 14%, commercial vehicles actually grew by 4% year-on-year, creating the overall figure of a 12% decrease.

It is the lowest number of cars made annually in the UK since 1954, excluding 2020, an anomaly as a result of the Covid pandemic.

Nor is the outlook for 2025 any rosier. In fact, car and van volume is predicted to fall further to 839,000 units as manufacturers continue to transform for EV production.

However, SMMT chief executive Mike Hawes told Autocar that he expected 2026 figures to increase above 2024’s, with the large-scale transition due to be complete by then and many more models running off the production lines. He said there is potential to get to above one million units in 2028, but this was dependent on “global demand improving, positive economic conditions and greater consumer confidence”.

JLR volume rose

In 2024, the number of vehicles built by Bentley, Nissan, Mini, Toyota and Stellantis all fell. JLR stands out as the only maker whose production rose, by 8%. This was bolstered by the success of Range Rover, given JLR ceased all Jaguar production during the year. Smaller brands including Aston Martin, Lotus, McLaren and Rolls-Royce’s figures are not listed individually in the published SMMT figures.

Nearly eight-in-ten cars were exported. More than half (54%) went to Europe, 16.9% to the US and 6.6% to China.

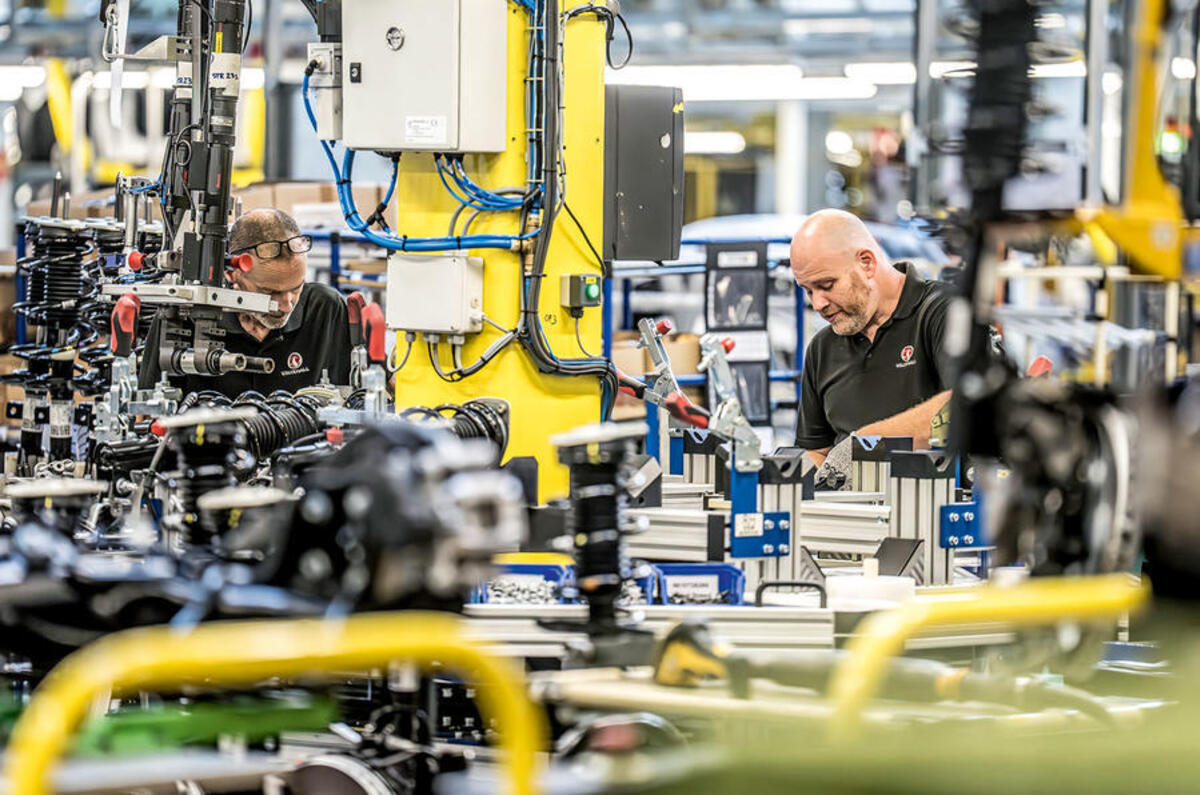

Hawes commented: “Amid significant geopolitical and trade tensions, UK manufacturers are set on turning billions of pounds of investment into production reality, transforming factories to make new electric vehicles for sale around the world.

“Growing pains are inevitable, so the drop in volumes last year is not surprising. With new models and battery production on the horizon, the potential for growth is clear. Securing this future requires industrial and trade strategies that deliver the competitive conditions essential for growth amidst an increasingly protectionist global environment.”

Mini, whose volume fell by 40% as a result of it no longer building the electric model, told Autocar that the volumes were “as planned” while Bentley, whose figures dropped by 17%, said its “performance was slightly reduced against previous years due to difficult market conditions and the result of lifecycle effects as we transition to new models recently introduced”. It added that it expected an uplift in 2025.

Add your comment