Few initiatives are more game-changing for the modern-day automotive industry than the zero-emission vehicle (ZEV) mandate.

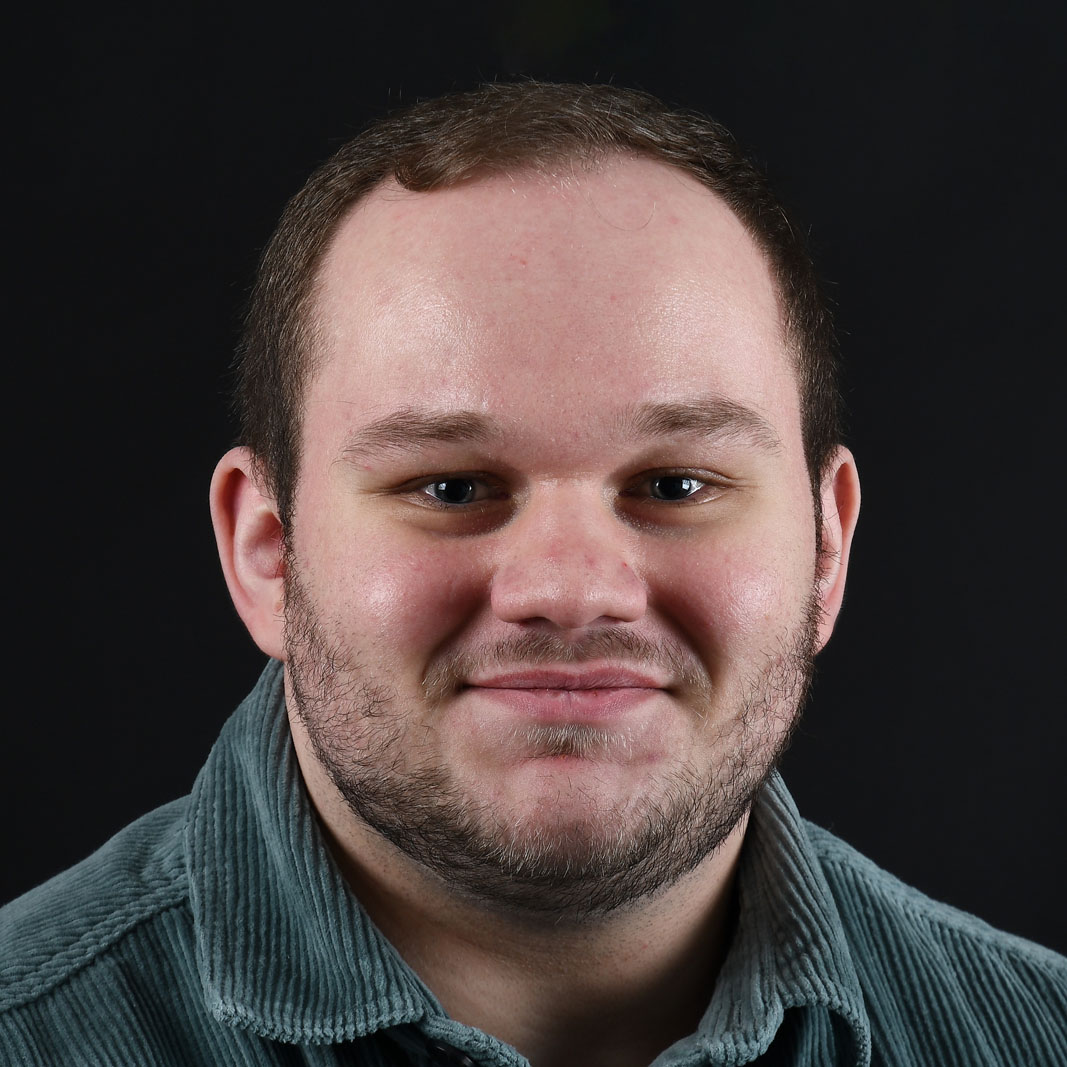

In fact, Mike Hawes, chief of the Society of Motor Manufacturers and Traders, has labeled the mandate “one of the most remarkable interventions in any industry ever”.

However dry and dull the ZEV mandate might sound, it’s a serious business for vehicles of all persuasions, including hybrids and electric cars.

It has caused car makers to build up entirely new teams of data analysts to manage compliance spreadsheets. And all this was only rubber-stamped towards the end of last year with just a few weeks’ notice.

Hawes’ description of the legislation, which creates a fine of £12,000 per non-compliant car sold over the limit, is a good temperature check for something that impacts and influences every single car sold in the UK and will continue to do so until at least the end of the decade.

What is the ZEV mandate?

Sitting comfortably? You might not be if you work for a car manufacturer, but you will want to know how it all works anyway.

A ZEV is defined as having zero CO2 emissions at the tailpipe and an electric driving range of at least 100 miles on the WLTP test cycle.

The ZEV mandate is an initiative that requires car makers to sell a certain number of electric vehicles each year.

The UK legislation requires car makers to sell an increasing proportion of ZEVs annually, starting at 22% in 2024 and hitting 80% in 2030.

A battery warranty of eight years or 100,000 miles must be provided as part of the mandate (so don’t fall for any manufacturer's advertising this as a perk; it’s an eligibility requirement), and if the battery falls below 70% capacity in that time, a replacement must be offered.

The ZEV mandate sits within the wider Climate Change Act and is loosely based on California’s approach to EV adoption. A key difference is that the Californian system has been tweaked multiple times in response to industry and market developments, and it allows for PHEVs, backed by incentives.

It’s a legislation that runs far deeper than the headline of a sliding scale of EV sales that each car maker must hit each year. It’s all part of the UK’s legislated commitment to be net-zero on carbon emissions by 2050.

Join the debate

Add your comment

People are making a lot of fuss about what i see as (almost) no change at all. So to start with after 2030 we had undefined hybrids, then Sunak said it can be any ICE, and now we are told it can be normal hybrids for definite. However, we are still talking about only 20% of the market in 2030 (and i assume reducing through to 2035), so these are still going to be the expensive cars the manufacturers can make the most profit on. We are not going to see city cars continue to be sold, and although a tiny proportion of the market, what about sports cars? Currently there is not one full hybrid for sale with a manual box. Maybe someone like Toyota will invent something, but i dont think these rule changes move the dial one bit for normal people who want an affordable,relaible, fun car. Oh, and dropping the fine to £12k. well that might help Bentley, but its not going to see any more Kia Picanto's being sold is it!

I understand reducing the fine, and giving hybrids an extra couple of years might have been reasonable - but the full five years, with a complete exemption for that period for commerical vehicles, is very disappointing. Okay Trump has just unleashed hell on the global economy, and something had to be done to give the industry a chance to survive the trade meltdown that will result, but throwing the environment under the bus is just giving him another (insane) thing he wants.

It's all about getting your vote then they renange, THEY all do it!

I followed a 2011 Merc E Class diesel in traffic this morning. It was chucking out plumes of disgusting diesel fumes like an out of control bonfire. If the ZEV mandate means we have to put up with less of this pathetic 'diesel engineering', I'm all for it.