It seems strange - but hopefully not wrong - to be worrying about business at a time many people are worrying about their lives.

However, the harsh reality is that there are more than a 1.5m people employed in the UK automotive industry (and 8m in the US, and 14m across Europe), covering everything from suppliers to manufacturers to retailers, many of whom will be worrying about life beyond the bug, when the economic realities of what is happening bite, as surely they will.

How the motoring industry is reacting to the coronavirus outbreak

Perhaps the only thing we can be certain of today is that nothing is certain, and it is with that front of mind that I heavily caveat all that I am about to write. But it is also true that this is a global situation, with different countries at different stages of the outbreak, and that within those caveats there might be insights and lessons to be learned.

At this early stage, China is perhaps the obvious country to look to, with Wuhan now famous for all the wrong reasons as the epicentre of the pandemic not long into the New Year, but announcing yesterday that it had recorded no new domestic cases of the flu. Nobody can be certain for how long, but for now, the depths of crisis have passed, and some kind of new normal is emerging.

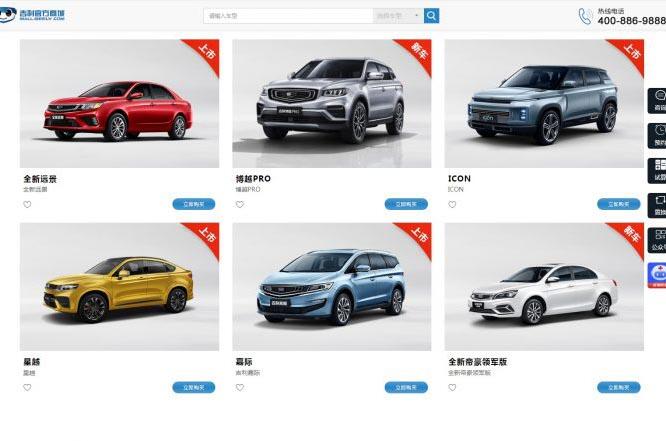

The bald facts of the sales slump in China make alarming if now familiar reading. Following the outbreak, parts of the country shut down; large swathes of factories - many automotive orientated - closed. Likewise car retailers, who were ordered to shut; large parts of the population were not only locked down, but had little to no interest in buying cars.

In the first half of February, new car registrations were down 92% year-on-year. A market of 1.8m registrations in January had fallen to become one of 250,000 in February - but already there were signs of an industry that was adapting to the situation. The figures were still brutal, but that first-half collapse had ‘recovered’ by the end of February to become a total 81.7% year-on-year drop for the month. For the first 15 days of March that year-on-year fall was 47% - or to put a more positive spin, more than halfway to recovery.

Then, yesterday, during VW’s annual results conference, VW’s CFO Frank Witter estimated that the market in March would be between 0.8-1m units. The bounce has begun in earnest. How so?

My sources are many and varied, but do not wish to be named for talking car sales in a crisis. All work for what I would define as front-foot, major league car makers or car retailers. Some represent the mass market, some luxury. It is clear that the top end has been less affected than the middle.

However, there are some common themes in how they responded and what they now face. In all cases I am aware that there is a natural human instinct to highlight the positives, but the numbers they quote suggest that their assertions are born out by the reality.

The first - and key - point they all make is that they did not stop working. It sounds obvious, but the period during which interest crashed was also one of decisive action for some. All consider this to have been crucial to their recovery.

For instance, after an initial, profound slump, they noted that as definite actions were enforced and workers told to isolate, web traffic was booming - as well it might with people stuck at home. Some of their activity was aimed at turning this interest into a pipeline of future sales, but all also noted how eager some would-be buyers were to push on with a transaction. All ramped up investment and staffing through their online sales channels as a result.

Join the debate

Add your comment

Really? This right now?

Right now though, here many are wondering if they are about to lose thier jobs as whole industries shut down. I wish everyone safety and continued good health, and I fully realise the jobs of many of you are at risk.

Perhaps though an article setting out the efforts of salesman to close the deals as soon as things start recovering could be seen as insensitive to some, especially as we arnt fully into the outbreak here.