Despite insurers blaming recent sharp rises in the cost of motor insurance on inflation, many are continuing to charge wildly different premiums for the same vehicle, throwing doubt on the reasons given for the increases and putting some motorists at risk of paying much more for their insurance than other drivers.

In its latest quarterly bulletin, the Association of British Insurers (ABI) reported that the average insurance premium paid by motorists between April and June this year was £511, an increase of 21% on the same period last year.

Renewals were priced at an average of £471, while new policies hit £566. The figures quoted are for average prices paid rather than quoted, which tend to be higher and which, according to Consumer Intelligence, increased by 48% in the 12 months to June this year.

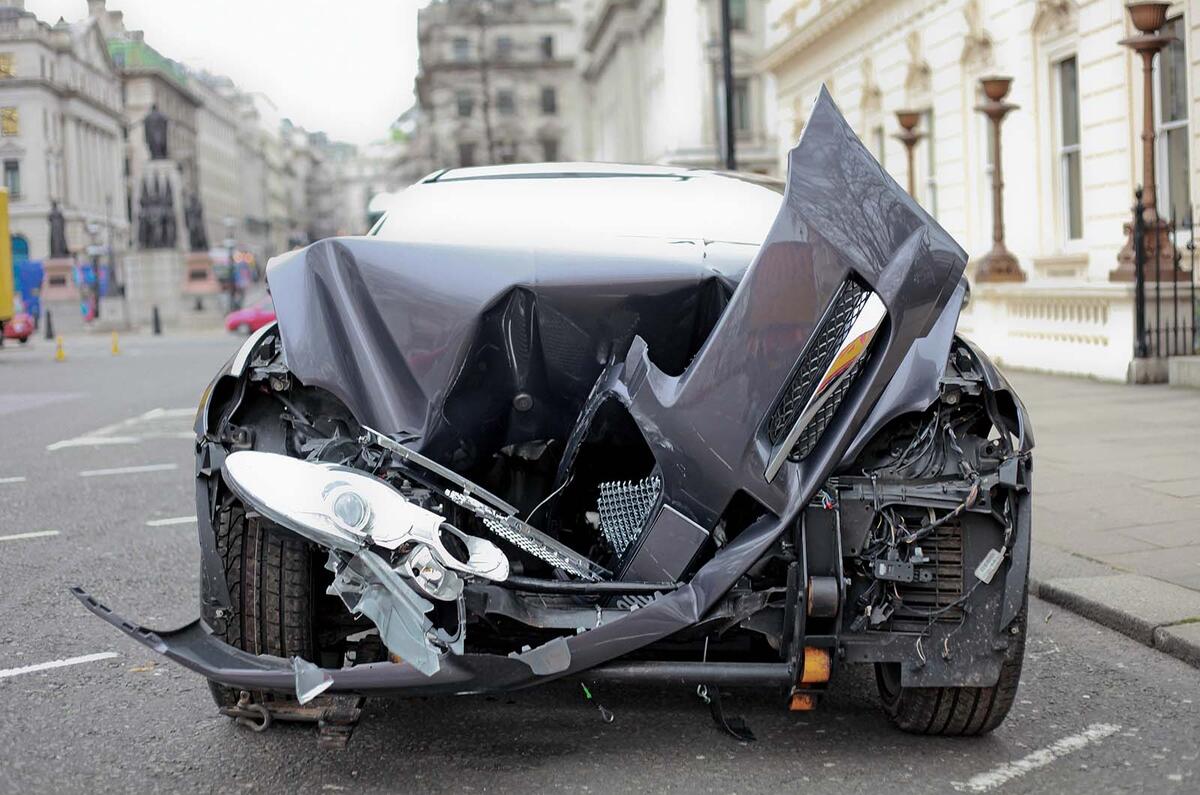

The ABI blamed the increases on a number of factors: the £2.4 billion insurers paid out for vehicle parts and repairs, the costs of which have risen by 33%; the cost of replacement cars, which are up 29%; and on personal injury claims, which, in the first quarter of the year, were 14% higher than in the same period last year.

Autocar has found that despite these universal increases, insurers are still quoting very different premiums for the same vehicle and driver.

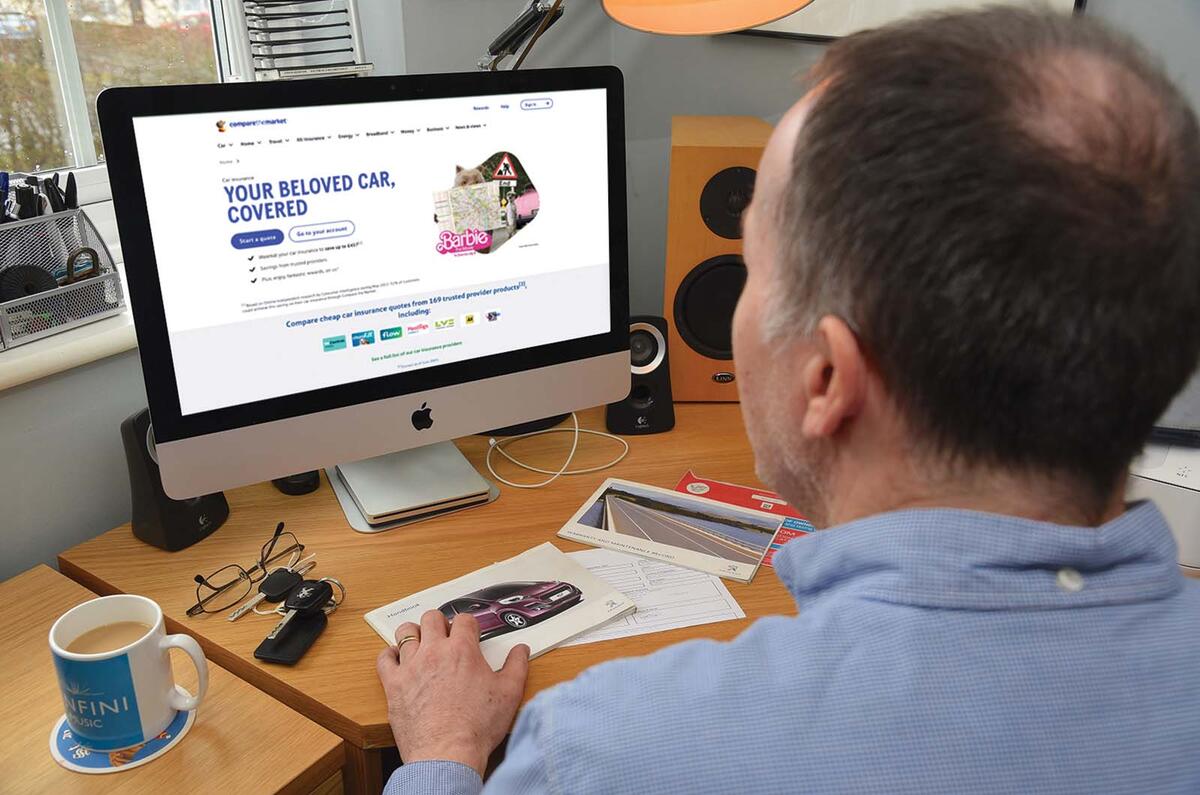

For example, for a Volkswagen Golf insured by a 63-year-old, Compare the Market generated 129 quotes ranging from £340 to £4464. Tim Kelly, an insurance expert and founder of Motor Claim Guru, says this proves that despite the inflationary pressures they claim to be under, insurers are still ‘cherrypicking’ business.

“The issue of premiums rising because of inflation is an illusion on the part of some insurers who have increased them only to price themselves out of certain areas of the market for business reasons,” he said.

He added they are doing this against the backdrop of declining investment returns. “Insurers make much of their profit from investing premiums, but this income has fallen, making them more exposed to the effect of inflation,” he said.

“They could fill the hole in their revenues from the profits made during Covid when people were driving less and claims fell. But they’re passing all of the cost on to motorists.”

Responding to Autocar’s research, Ursula Gibbs, director at Compare the Market, said: “Compare the Market’s latest data has revealed that average car insurance premiums have increased by up to £208 year on year, reaching £743 in June 2023.

Join the debate

Add your comment

As we said at the time, it was always going to happen. The problem was Consumer rights tried to change the expression 'You can lead a horse to water but can't make it drink' to '...and we will make it drink'.

The way to obtain the best price is to compare prices and play companies off against each other. I really admire people such as Martin Lewis, they were preaching this 'shop until you drop' for years. But of course we also have the lazy burgers, those consumers who can't be ar5ed. They happily pay their higher renewals then complain.

Where it all went wrong was when Lewis & Co abandoned the savvy shopper and fought on behalf of those lazy sods. Was he and the other consumer champions really that stupid to think insurers would reduce their prices when they could no longer offer intoductory discounts?

I challenged the price of premiums earlier this year. Time and time again when I called for quotes, the broker would say " by law we're no longer able to... etc " Consumer rights just gave them the perfect excuse to charge more. ' We've had to increase prices BY LAW! '

Stupid doesn't even begin to describe what happened because it was always going to act against rather in favour of consumers.

Martin Lewis etc viewed insurance premiuns as having 'introductory discounts'. They should have been viewed as having 'renewal surcharges'.

How to reduce premiums? Somebody might want investigate the level of corruption withing the industry. I've had first hand experience of an insurer not giving a toss about being screwed by the 3rd party - just pay out and recoup their money via increased premiums.

Civic Type R - £136 in 2021, £250 in 2022 and £411 this month same details/NCB etc

Increases of 83% and 64% = 302% in 2 years if thats not profiteering dont know what is

They are rip off merchants... twice now at renewal I went in online chat to a large insurer and said I want to cancel the auto renewal (annoying default they should be opt in not opt out) and instantly been offered a substantial discount to stay.Usually I switch every year, renewal is always used as a chance to try on a profit hike which as I mentioned they seem to be able to make vanish by you simply asking.