European new car sales surged to 1.34 million cars in April, representing a 9% increase compared with the same month in 2017 and a stark contrast to the 5.2% decline seen in March.

The UK contributed to the growth with its 10.4% boost in new car sales, which was helped by two additional buying days in April and changes to vehicle excise duty. Europe’s biggest car buyer, Germany, recorded an 8% growth in registrations and there was an 8.9% increase in the French market.

“April 2018 was an abnormal month, because many unusual factors helped to accelerate growth,” Felipe Munoz, a global car market analyst at JATO said. “However, these results show that there’s a positive mood among both consumers and car makers, as more models hit the market and more alternatives to diesel cars become available.”

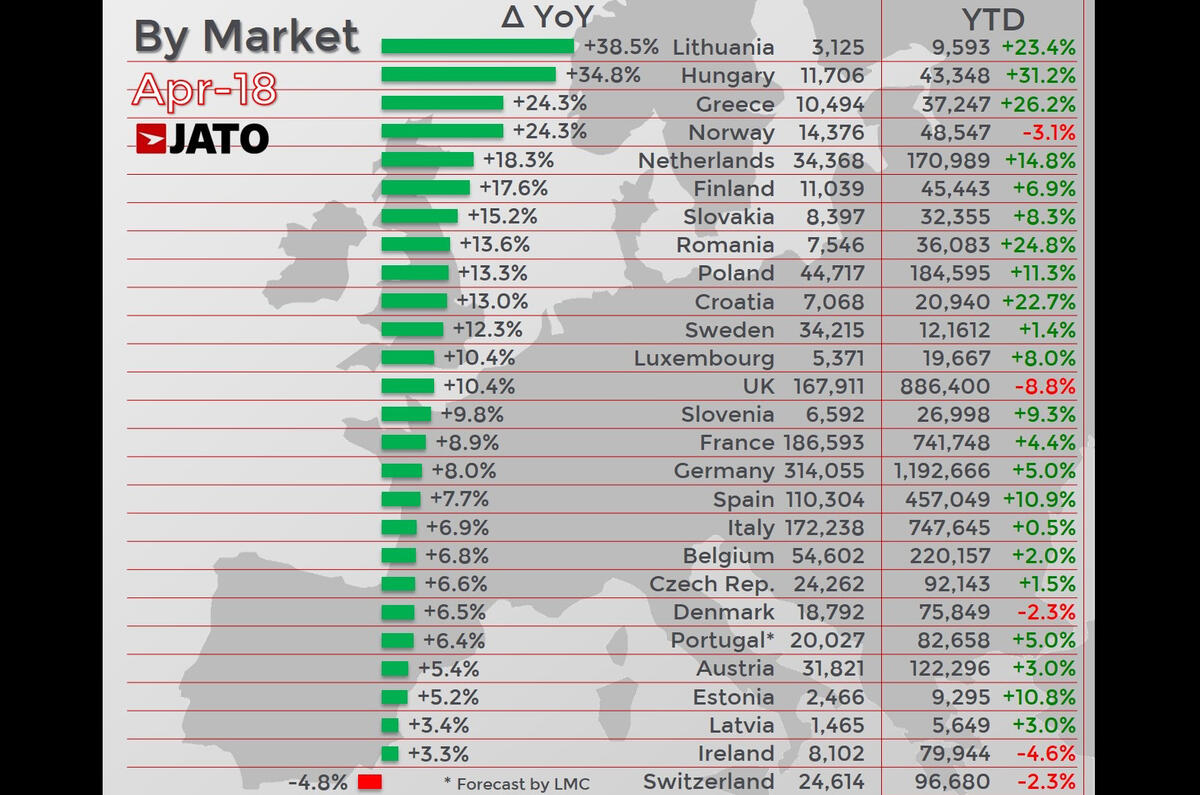

Of the 27 European markets, only Switzerland experienced a decrease in sales during April, with sales there down by 4.8% compared with April 2017. The Swiss market is down 2.3% down for the year to date. Despite the UK's resurgence, it is still 8.8% down for the year to date.

Despite the overall growth enjoyed across the continent, demand for diesel cars continued to tumble. European registrations of new oil-burners were down by 13.2% to 453,500 units. In terms of market share according to fuel type, diesel now has a 36.7% share.

Top 10 best-selling cars in Britain

By contrast, petrol car sales grew by 53.5% to 692,300 units, giving the fuel type a market share of 56.1%. Petrol car sales growth recently contributed to the first growth in car CO2 output since records began.

Alternative fuelled vehicles - chiefly hybrids and electric vehicles – continued to sell in larger numbers, however, with registrations up by 53.5%. Although this still leaves the segment representing just 5.5% of total sales. Hybrid cars were the most popular of the class, with 41,200 registrations, while 13,500 were for plug-in hybrids and 13,000 for all-electric models.

SUVs continued to take hold of the market in April, ranking as the top-selling segment in 24 of Europe’s 27 markets. SUVs now account for 33.3% of the new market share, up from 21.4% just three years earlier.

The most popular car in Europe during April, however, was the Volkswagen Golf, with 39,356 registrations, while its new sibling, the T-Roc SUV, was the most sought-after market newcomer with 12,950 registrations. British buyers continued to demand the Ford Fiesta, with registrations for that car totalling 7811 here in April.

Join the debate

Add your comment

The Colonel

"With one year to go until the UK departs the EU, the trade association for the car sector has issued a fresh ferocious Brexit warning, cautioning that a cliff edge – even after the agreed transition period – would be disastrous for one of Britain’s most important industries. The Society of Motor Manufacturers and Traders (SMMT) said on Wednesday that while the recently established transition deal between the UK and the EU “provides some welcome breathing space” the industry still needs to see rapid progress and clarity on many fronts."

"Brexit uncertainty blamed (by SMMT) as UK car sales fall"

"March decline for UK car manufacturing as industry repeats call for continued membership of customs union" Source - SMMT's own website!

So (The Colonel) try and stay focused, if you can.

Woah, what?

So UK was 10.4%

Germany was 8%

France was 8.9%

!!!

Weren't the SMMT blaming Brexit a month ago? Will they be releasing an apology? I see there was a little enquiry into Osborne's statement almost exactly two years ago (based on a Treasury report) that Brexit might cost up to 800,000 jobs IMMEDIATELY after a Leave vote...only for employment to actually go UP by 2%.

Blaming Brexit?

"Weren't the SMMT blaming Brexit a month ago? "

No.

The Colonel

The internet is easy to check, so let's see...

BREXIT business boom

10 per cent growth!

The Remainers told us that the UK economy would collapse if we voted to leave the EU.

They lied to us.

max1e6 wrote:

You must have missed the bit that said the UK is still down by 8.8% so far in 2018 vs 2017.....

Interestingly the likes of JLR and SMMT like to blame this on falling diesel sales. But diesel mix is falling at the same rate in Germany, but the market remains up.

To me this clearly lays the blame squarely at the door of Brexit. Consumers are unclear on how that's going to play out so they are delaying their new car purchases.

Nothing to do with diesel.

Qu

Then why would the most RECENT month be up then? I could understand your comment if there was a continuing decline.

max1e6 wrote:

But nothing has been put into place, or changed yet, so maybe, just maybe, Brexit has nothing to do with this.