The McLaren Group has secured a £550 million cash injection from a group of new and existing shareholders, which it says will support its “growth plans as a global luxury supercar and elite motorsport business”.

Some £400m in capital comes from funds managed by investment firm Ares Management Corporation and Saudi Arabia's Public Investment Fund.

The Financial Times notes that the latter also holds shares in American EV manufacturer Lucid, but that there has been no talk of technology-sharing between it and McLaren.

This cash is supplemented by a £150m capital injection from existing shareholders, including Bahrain's Mumtalakat sovereign wealth fund and “a limited number of new private investors”, which will go towards repaying a loan that McLaren took out in June 2020 from the Bank of Bahrain.

This financial boost for the McLaren Group follows US sports investment group MSP Sports Capital’s acquisition of a 15% share in the McLaren Racing division in December for £185m.

This transaction, McLaren said, allowed Woking to “retain a significant stake in its Formula 1 team while bringing in strategic partner capital to de-risk Racing and allow McLaren to focus on its leading Automotive business”.

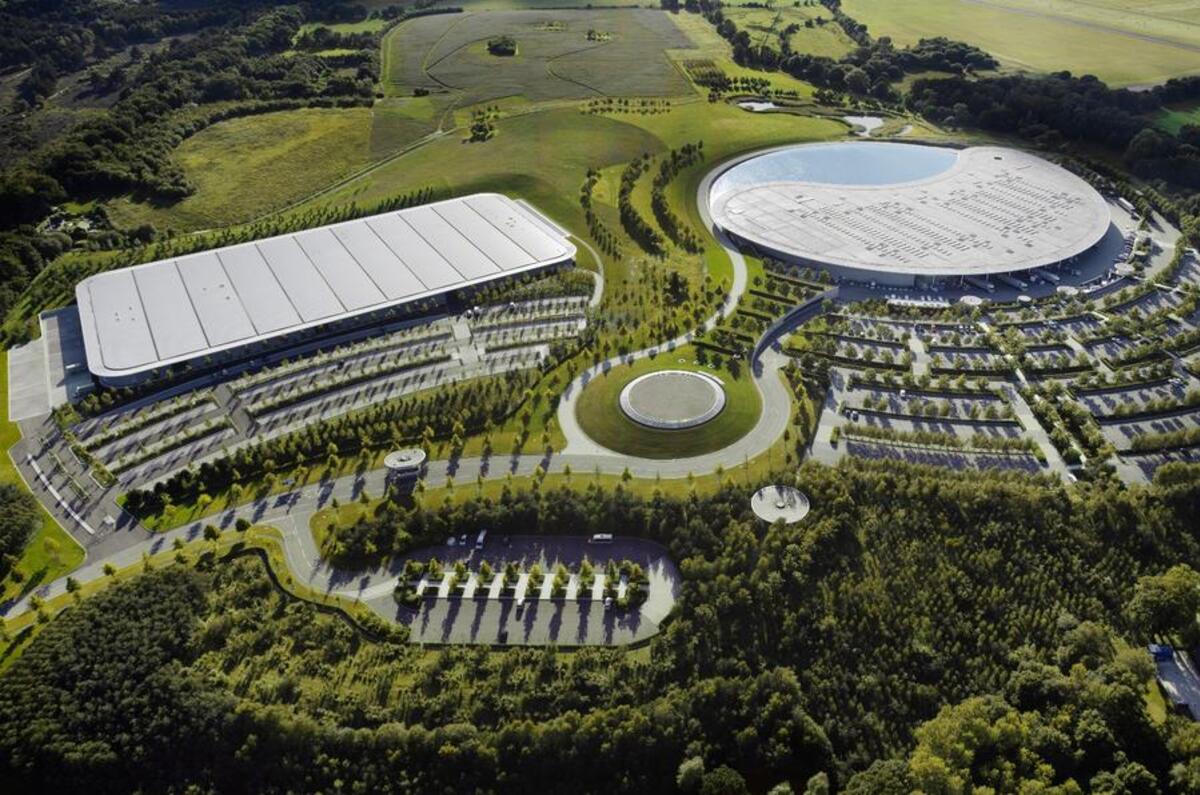

More recently, this April, McLaren sold its Woking headquarters for £170m to investment firm GNL, securing a 20-year lease on the property as part of the agreement.

McLaren said the “strong appetite” from investors reflects their “continued confidence” in the brand. "We look forward to working with Ares and PIF as they contribute their experience and knowledge to the board,” it added.

McLaren Group executive chairman Paul Walsh said: “Building on the short-term measures that we put in place last summer in response to the global pandemic, McLaren has taken a number of significant steps to put the company on a stable footing for the long-term, with the close support of its advisors and existing shareholders.

“Following the strategic investment into Racing that we secured last year, this successful equity raise is a key element of our comprehensive financial strategy to support the Group’s sustainable growth plans."

READ MORE

Join the debate

Add your comment

I admire McLaren for both the road cars they offer and their F1 efforts, but articles like this only convince me that they are a brand heading towards ruin. Time to cozy up with one of the big boys. Worked for Bentley, Rolls and Ducati??

It does seem a shame they had to sell their HQ before this investment came in. All it does is push future liabilities down the road.