Global companies are plotting a fightback in China against the rise of Chinese brands, with next week’s Shanghai motor show offering them the perfect stage to show off their recovery.

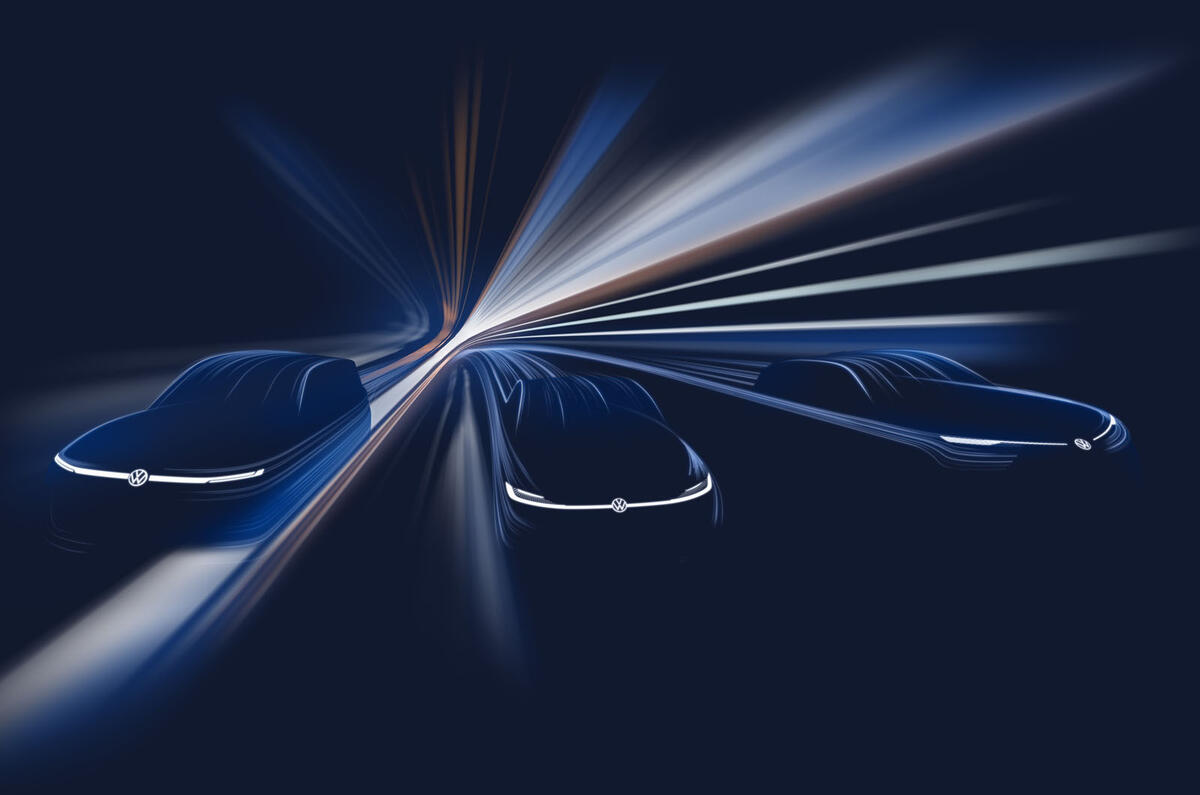

New models from the likes of Audi, Lexus, Mazda, Mercedes, Nissan and Volkswagen will take to the stands in a bid to convince showgoers that they're still relevant in this electrified, tech-led age.

Add your comment