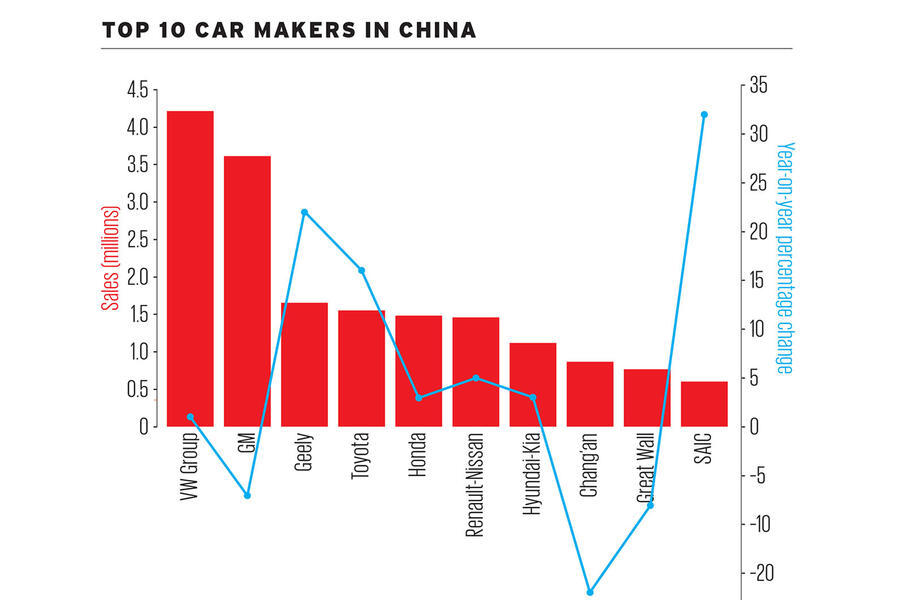

Last year was tumultuous for the global car industry, with its biggest market, China, contracting for the first time in nearly 30 years.

Shockwaves from this drop are still being felt around the globe, amplified by subdued sales in the US, Germany and the UK. Of course, there were also winners in the global car sales game – India is closing the gap on Germany and Brazil recorded significant growth.

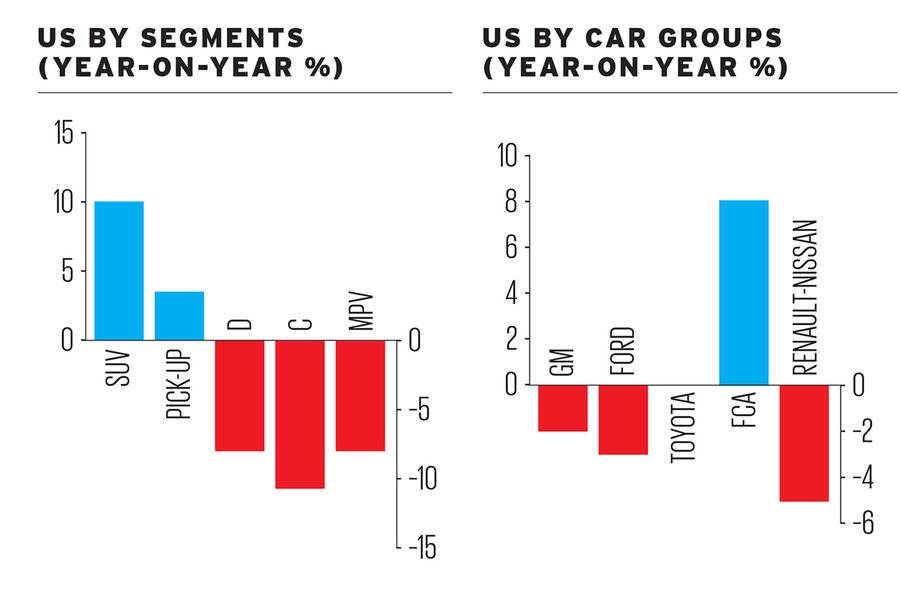

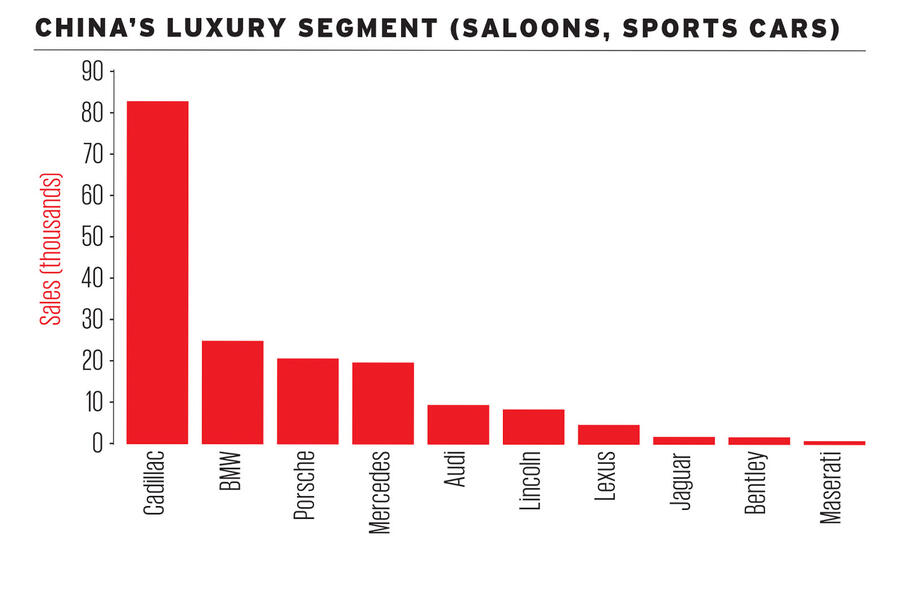

SUVs remain the sector to trade in, contributing one in three global sales, with each of the four main sub-segments experiencing growth. And despite overall poor sales in China, demand for luxury cars and some imported brands was buoyant.

The electric cars market continues to grow significantly, albeit from a small base, and two of the most famous nameplates in the car business – the Porsche 911 and Ford Mustang – strengthened their hold on their respective supercar and sports car/coupé markets.

All these figures were supplied by industry analyst Jato Dynamics and are based on preliminary data for 53 markets, which account for 85% of the global total.

SUVs prove rugged as roll continues

This is the story of SUVs and their growing popularity. The formula of a raised driving position, rugged styling and practical passenger/ luggage spaces appeals around the globe, especially in markets with rough roads.

“But this positive result means difficult times for the regular popular segments: compacts, subcompacts, mid-size and especially MPVs,” says Munoz.

Sales of pick-ups, including US ‘trucks’, are booming not only in North America, but in Brazil and Thailand, too. Jato believes that the SUV boom is long-lasting and stable, not like other short-lived market trends.

China slump accounts for gloom, but spike brings cheer to Brazil

With the established global economies stuttering, the good news last year came from emerging economies such as Brazil, Russia, Thailand, Indonesia and India, which continues to close on Germany. “The better economic and political mood, along with renewed key models including SUVs, boosted these markets,” says Felipe Munoz, Jato’s global analyst.

Did India pass Germany as the world’s fourth biggest market for car sales?

“Not yet, but that is getting close,” says Jato, “and is expected to happen in the next two to three years.” India, with a population of more than one billion increasingly affuent possible car buyers, has huge growth potential. The same cannot be said for Germany, with a population of 83 million and a high percentage of car ownership already.

Join the debate

Add your comment

Contradiction?

Contradiction?

Refering to the text re us sales, and the comment that no one wants small or saloon cars, it then goes on to say the only winner being tesla with its model 3, this is both small and a saloon, so clearly there is a market in the us for this type of car as the 3 is doing really rather well.

Im not totally convinced by the suv fad as a lot of cross overs like ford actives etc seem to be lumped in with suvs, with their lower prices and running costs over an equivalent full suv but still with a raised driving position and tough looks, I reckon crossovers will overtake full suvs, thing is we used to categorise full off roaders like discoverys as different to soft roaders like sportages and rav4 etc, now they're all suvs, so I am unsure as to what is what when referring to suvs.

"A challenging year in Europe

"A challenging year in Europe was characterised by Brexit, controversy over diesel emissions and production shortages of new WLTP-compliant engines – all of which had a negative effect."

Nope. Brexit hasn't happened. You mean uncertainty...but that's only in the UK sector, it doesn't affect Europe. NO ONE in France is holding back buying a car because of Brexit!!!

Interesting stats - so more

Interesting stats - so more cars were sold in the UK than France? And the largest growth in sales was B-SUVs? As I point out on the Tesla article, why is Tesla going with larger cars rather than B-SUVs?. And why isn't JLR going for B-SUVs? I also never realised JLR's sales in China were so poor (in comparison with others) even before the downturn. Is it worth bothering with?

No sign of Mike Hawes (and some ignorant people on here) saying that global downturn is due to Brexit???