Onto, one of the UK’s largest electric car subscription providers, has entered administration following the loss of key financial backer Legal & General (L&G).

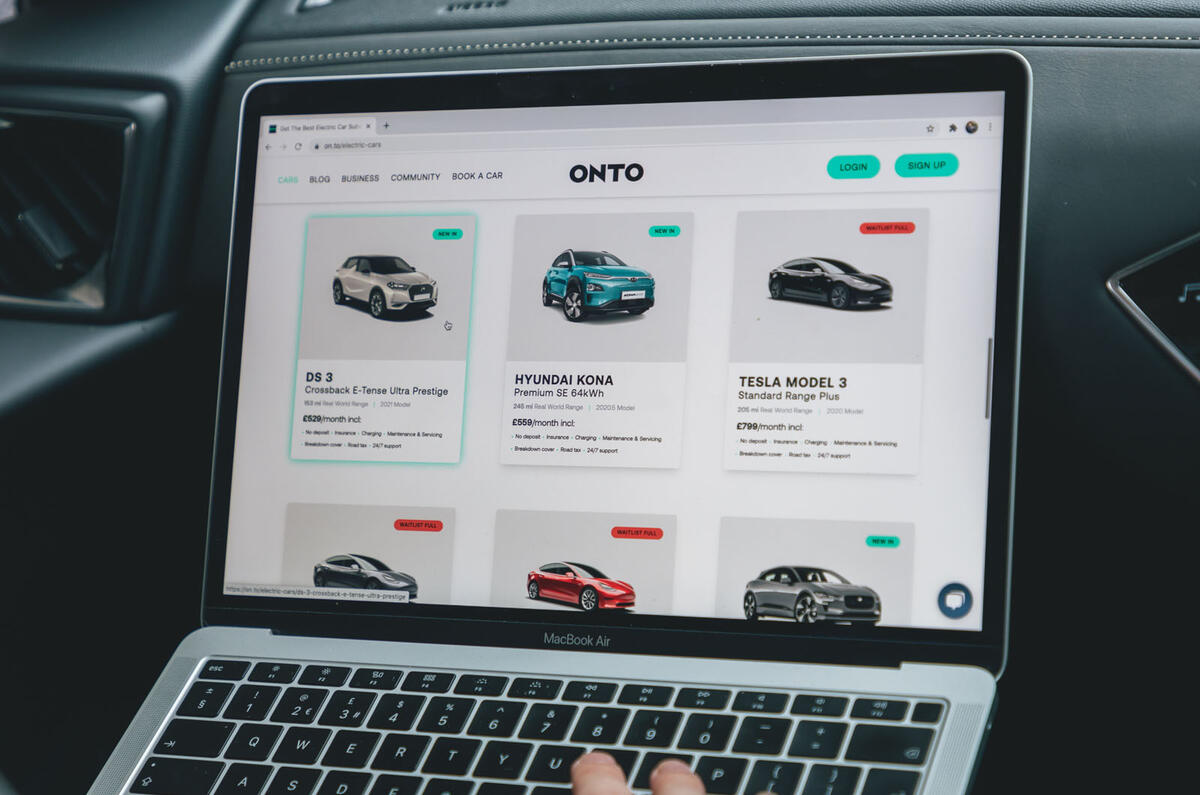

The company offered flexible leases on EVs, charging zero upfront deposit and rolling extras such as insurance tax into one monthly subscription fee.

Add your comment