When you’re buying a car, the dealer will invariably offer you GAP insurance. But should you simply take the policy offered to you, or is it worth spending a bit of time shopping around for a better deal?

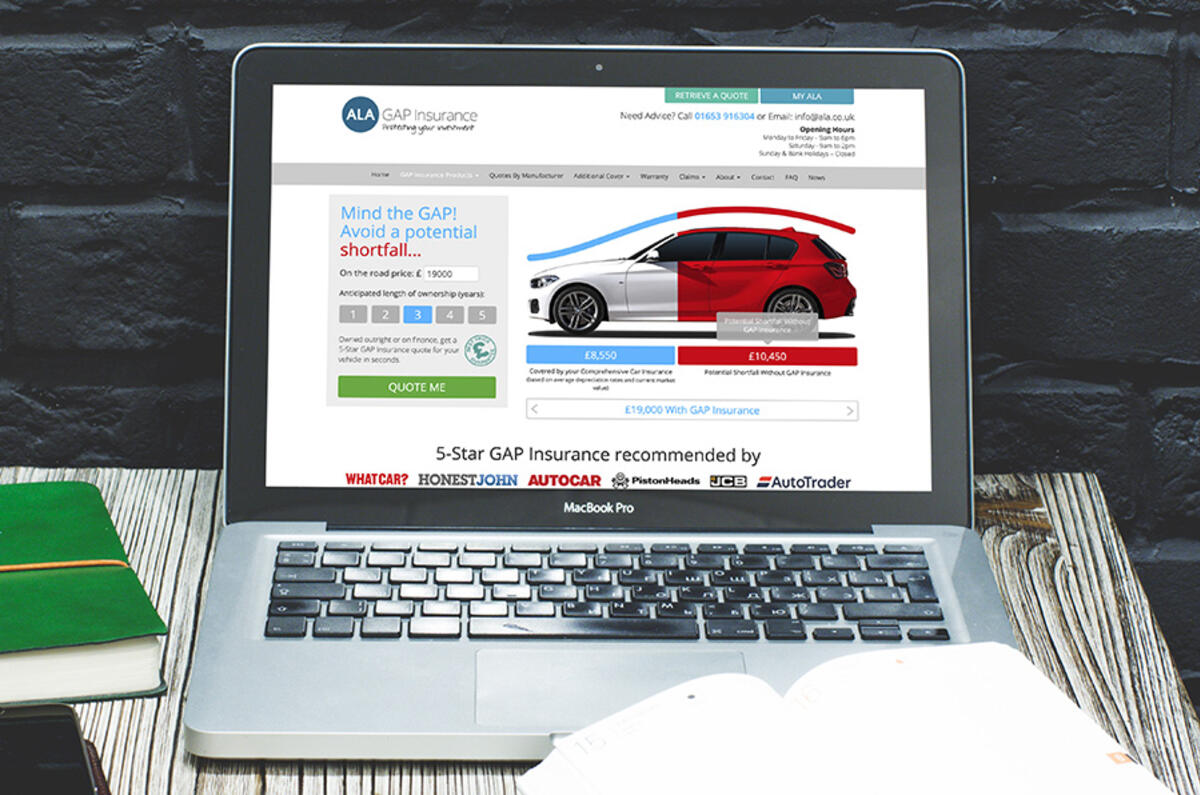

GAP insurance (or Guaranteed Asset Protection insurance to give it the full name) is a useful safety net that covers you against the financial loss of depreciation if your car is stolen or written off – bridging the gap between what your comprehensive insurer pays out, and what you paid for the car.

With an array of different policies offering different benefits for your needs, though, finding the right cover at the right price is essential. Shopping around will almost always yield lower prices or more favourable cover than that offered by dealerships.

To find out more about the car-related services that ALA Insurance offer, head to ala.co.uk

What are the benefits of shopping online?

“When you buy a car through a dealership, they will often offer you GAP insurance cover with apparently little choice in the policy,” says ALA Insurance expert Jason Allen. “It doesn’t take much investigation, though, to realise that there are much better deals to be had.”

Car dealerships are brokers – placing their own profit margins on top of the cover, which makes the insurance more expensive. But it’s not just lower prices that customers should look for when shopping for GAP insurance online.

“Price aside, policies offered online generally have much better terms than those offered through the dealer,” says Jason. “Mainly because you’re dealing directly with a specialist GAP insurance company.”

As Jason explains, the basic ‘Return to Invoice’ cover offered by most dealerships is a one-size-fits-all policy – but it’s one that isn’t suitable for everyone’s needs or their financial situation. Shopping around for GAP insurance not only saves you money, it can also return far more comprehensive cover.

What should you look for in GAP insurance?

There are many factors that define a good GAP insurance policy; price, excess, days to claim and policy transfers are all elements to consider when purchasing cover.

“With an ALA Insurance policy you can get up to £500 of excess covered as standard, whereas it will usually stop at £250 with car dealer policies,” says Jason. “You will also get longer to make a claim with an ALA Insurance policy – up to 120 days – whereas with dealer policies it’s generally 30 or 60 days. You’re also able to transfer these policies, something you’re not generally able to do through a dealer.”

Add your comment